What we can infer from the US Treasuries latest auction results with regard to the health of the economy

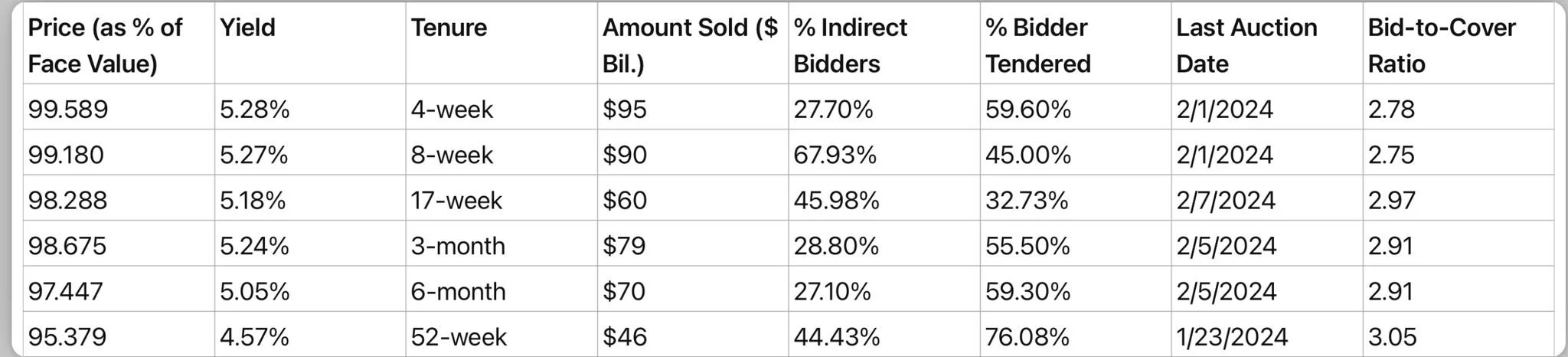

(1) Summary of Treasury Bills Auction Results:

The auction results for Treasury bills indicate a cautious approach by investors. The yields on these short-term securities, such as 5.28% for the 4-week bill, are relatively high. This suggests expectations of higher short-term interest rates or inflation. It could be a response to economic indicators like rising inflation or anticipations of a tighter monetary policy. Alternatively, it may indicate that the Federal Reserve is expected to hold interest rates steady in the near term, at least for the first 3-6 months. A rate cut is not yet a certainty as far as the bills are concerned.

(2) Summary of Treasury Notes Auction Results:

For Treasury notes, the auction results show a higher demand for medium to long-term investments. The yields, ranging from 4.06% to 4.42% for various maturities, are indicative of investors seeking higher returns, possibly due to concerns about long-term economic growth or inflation. The pricing of these notes, with shorter maturities trading slightly below par and longer maturities above par, suggests a balanced demand for medium-term and strong demand for long-term securities. This trend reflects investor preference for stability and safety in the face of future economic uncertainties.

(3) Investor Sentiment and Economic Outlook:

Overall, the results from both bills and notes auctions reflect a cautious sentiment among investors. There is a clear preference for the safety and stability offered by U.S. government securities, indicating concerns about near-term economic risks and long-term uncertainties. This cautiousness could stem from various factors, including inflation concerns, global economic conditions, and expectations of changes in monetary policy.

(4) Conclusion:

The U.S. Treasury auction results for both bills and notes suggest a market characterized by caution and a defensive stance. Investors seem to be balancing short-term economic risks against the stability offered by long-term government debt. This behavior is typical in periods of economic uncertainty or expected policy shifts. The preference for government securities indicates a flight to safety, reflecting concerns about inflation and interest rate changes, and underscores the ongoing search for secure investment avenues in a potentially volatile economic environment.