Singapore Property Outlook: A Comprehensive Strategy for Buyers

Singapore’s property market continues to attract local and international buyers, offering stability and long-term growth. By integrating global economic correlations and recurrent neural network (RNN) predictive insights, this analysis provides a holistic view of the market dynamics across the Outside Central Region (OCR), Rest of Central Region (RCR) and Core Central Region (CCR). It combines these data-driven insights with a strategic framework for navigating market risks and opportunities while maximizing potential returns.

Market Dynamics: Insights from Data Analysis

1. Correlation Analysis

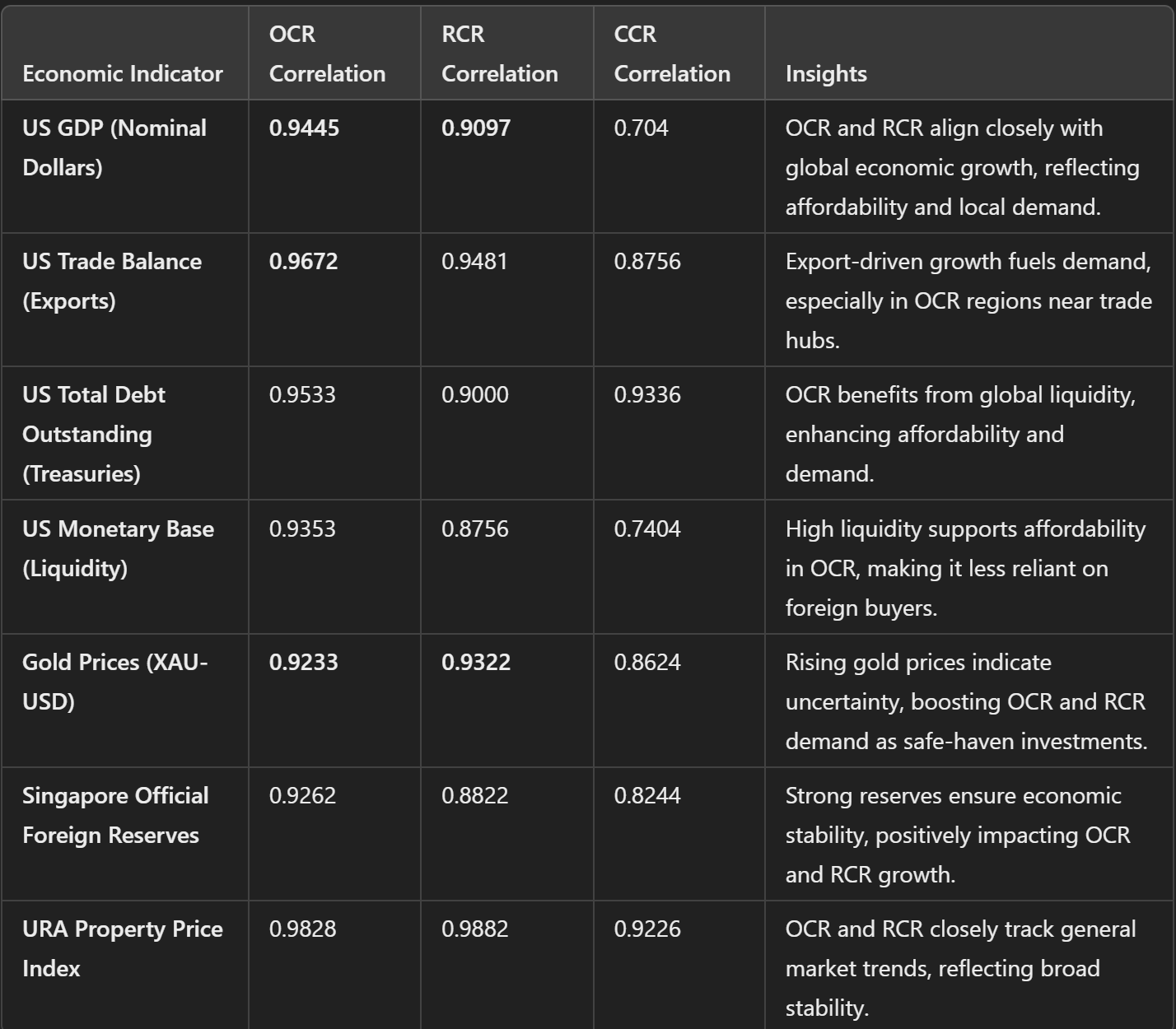

Using historical data, the relationship between global economic indicators and Singapore’s property indices (URPINOCR Index, URPINRCR Index, and URPINCCR Index) was evaluated to uncover key drivers of price movements.

2. Recurrent Neural Network Predictions

RNN models were used to forecast price corrections, providing deeper insights into short-term risks and opportunities.

Graph 1 - Actual and Prediction price index for OCR with 95% Confidence Interval Estimate

Graph 2- Actual and Prediction price index for RCR with 95% Confidence Interval Estimate

Graph 3 - Actual and Prediction price index for CCR with 95% Confidence Interval Estimate

Why OCR Aligns with Investor Goals

1. Strong Growth Potential

OCR’s correlation with global economic indicators, particularly US GDP (0.9445) and trade balances (0.9672), highlights its alignment with economic growth and liquidity. This underscores OCR’s potential for significant appreciation, driven by affordability, local demand, and infrastructure upgrades.

2. CCR as a Benchmark

The CCR sets a natural ceiling for OCR prices, currently averaging around above $2,700 psf. OCR properties priced between around below $1,700 psf offer substantial room for growth, aligning with long-term market trends.

3. Infrastructure and Demand

Government-led projects, such as the Jurong Region Line and Cross Island Line, ensure sustained demand for OCR properties in emerging growth hubs like Jurong Lake District, Punggol, and Tampines.

Strategic Recommendations

1. Focus on Emerging OCR Projects

Buy in developments priced below $1,700 psf in regions undergoing significant transformation:

Jurong Lake District: Positioned as Singapore’s second CBD, with extensive infrastructure developments.

Punggol Digital District: A hub for technology and innovation, attracting professionals and young families.

Tampines North: An established regional hub benefiting from continuous upgrades.

2. Leverage CCR Benchmarks

Use CCR’s $2,500–$2,700 psf pricing as a benchmark for OCR investments, ensuring sufficient room for appreciation without speculative risk.

3. Diversify Across OCR and RCR

While OCR offers high growth potential, select RCR properties near MRT lines and amenities provide stability and balance. These properties, priced moderately higher, cater to a different buyer segment, such as young professionals and expatriates.

4. Monitor Global Trends

Track economic indicators, such as US GDP growth, trade balances, and Singapore’s foreign reserves, to anticipate market movements and align investment timing.

Challenges and Risks

1. Oversupply Concerns

Localized oversupply in certain OCR areas may dampen price growth. Focus on developments with unique value propositions, such as proximity to MRT lines or regional hubs.

2. Policy Risks

Government cooling measures, such as ABSD or loan restrictions, could impact demand. Diversify investments to mitigate exposure to policy changes.

3. Rental Yield Constraints

High entry prices in certain projects may suppress rental yields. Prioritize properties with strong tenant demand, such as those near business parks or educational institutions.

Conclusion: A Balanced Approach for Property Investment

By integrating correlation analysis and RNN predictive insights, buyers can navigate the complexities of Singapore’s property market with confidence. The OCR stands out as the growth engine, supported by global economic alignment, infrastructure-led development, and affordability. RCR offers stability, while CCR presents selective long-term opportunities.

Key Takeaways for Investors

Prioritize Low Entry Prices: Focus on properties priced between below $1,700 psf to maximize potential returns.

Target High-Growth Areas: Invest in emerging OCR hubs with strong infrastructure and demand drivers.

Diversify Strategically: Balance OCR investments with select RCR properties to reduce risk.

Leverage Economic Trends: Monitor global and local indicators to align purchases with market cycles.

This comprehensive strategy ensures a well-rounded approach, balancing short-term gains and long-term resilience in Singapore’s evolving real estate landscape.

Note: RNN stands for Recurrent Neural Network, a type of artificial intelligence model designed to identify patterns in sequential data. In this context, RNNs were used to analyze historical property price trends and forecast future movements based on key economic and market indicators.

Some of the data referenced in this analysis is sourced from licensed platforms such as Bloomberg, ensuring the accuracy and reliability of the insights presented. The use of Bloomberg data, including economic indicators and property trends, adds depth to the understanding of the property market.