Navigating the Economic Road Ahead: Inflation, Wages, and the Potential for a Hard Landing

Introduction:

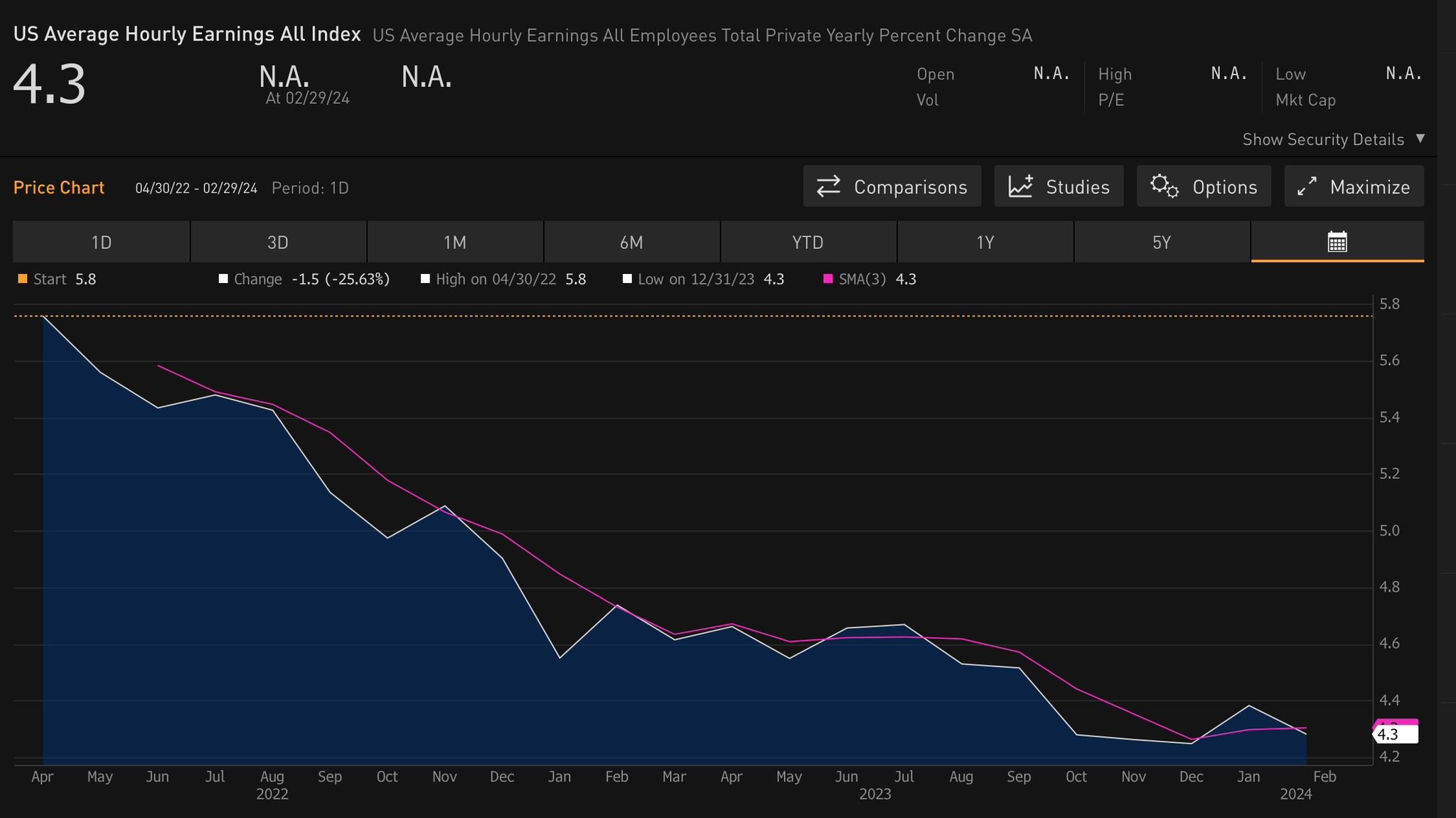

The state of the economy often feels as immediate as the dollars in our wallets and as complex as a global map of trade routes. In recent times, inflation has sprinted ahead, with prices climbing at a pace that has stretched household budgets. Wages, although increasing, have done so with less gusto, prompting a cautious optimism at best. As we observe inflation decelerating, it’s crucial to note that wage growth is also tapping the brakes, signalling a time for prudent economic planning.

In the shifting landscape of the U.S. economy, inflation’s retreat is met with slower wage growth, signalling a crucial moment for careful financial manoeuvring to avoid a hard economic landing.

Transition to Car Analogy:

Consider the journey of buying a new car, a universal experience that mirrors the current economic landscape. Car prices — much like inflation — have been racing ahead, putting pressure on buyers. Now, with prices stabilizing, the car lot — our marketplace — feels more accessible. Yet, the budget for this purchase, symbolic of our wages, isn’t keeping pace. The thrill of a price freeze loses its luster when your bank account isn’t equally robust.

Body of the Report:

In the car dealership of our economy, we, the consumers, are inspecting the latest models with cautious scrutiny. The displayed prices reflect a market adjusting to cooler inflation, yet the wallets — our wages — haven’t fully caught up. Economists and bankers pore over these figures, aware that fiscal decisions hinge on this delicate balance.

For families, the message is one of judicious budgeting: it may not be the time for the premium package when the standard will suffice. For bankers, the takeaway is in lending and investing strategies that mirror the market's caution. For the layman, the direction is straightforward: guard your savings, plan your expenditures.

Conclusion:

As we conclude this economic overview, replete with the year-over-year earnings chart, the emphasis is on equilibrium. An economy pushed too hard can lead to a ‘hard landing’ — a sudden and severe downturn. It’s akin to pushing an ageing vehicle beyond its limits on an uphill climb, risking a stall or a backslide. Instead, a ‘soft landing’ is the goal, where the economy gradually decelerates to a stable and sustainable growth rate without causing undue hardship.

A collective hand on the wheel is necessary to achieve this — from policymakers steering interest rates to families and businesses navigating their financial roadmaps. The balance of saving for tomorrow while investing in today is the fulcrum on which our economic stability rests. With careful navigation, informed by data and guided by prudence, the journey ahead can be one of measured progress rather than uncertain terrain.

Note: The chart from Bloomberg is included with appropriate licensing and is intended for illustrative purposes to provide a visual context to the discussed economic trends.

The Monetary Authority of Singapore (MAS) has been proactive in managing inflation through its monetary policy by allowing the Singapore dollar to appreciate, making imports cheaper and curbing price rises. Unlike the U.S., Singapore is not caught in the same wage and inflation struggle, which positions it well economically. As MAS continues to manage the Singapore dollar against major currencies, allowing for some appreciation, it aids in making Singapore more cost-competitive. This strategic approach should keep Singapore in good stead, while for investors, remaining cautious and awaiting clearer market signals seems wise, especially with uncertainties in the U.S. market. The U.S. dollar’s strength against the SGD is part of this broader strategy by MAS to maintain economic competitiveness

Note: Source on SGD easing: Bloomberg Report - Singapore Dollar’s Stellar Run Seen Ending on Monetary Easing (03/25/2024)