How the U.S. Can Establish a Sovereign Wealth Fund: Analysing Viability and Inflation Risk

Introduction

A sovereign wealth fund (SWF) allows a nation to accumulate surplus wealth and invest it for long-term economic stability. Unlike countries like Norway and Singapore, which built their SWFs from natural resource revenues or trade surpluses, the United States faces a unique challenge—it operates under persistent fiscal deficits and maintains the world’s dominant reserve currency. Despite this, there are multiple potential models for the U.S. to establish an SWF, each with different success probabilities and inflation risks.

This essay ranks these models based on two key criteria:

1. Success Potential – How feasible the model is for long-term sustainability.

2. Inflation Risk – Whether the strategy increases inflation in the short and long term.

1. Potential Funding Models for a U.S. Sovereign Wealth Fund

(A) Trade Surplus-Based Fund (Highest Success, Lowest Inflation)

• Mechanism: Redirect trade surplus revenues into an SWF, similar to China and Singapore.

• Feasibility: The U.S. would need to shift from a trade deficit to a surplus through export-driven policies.

• Inflation Risk: Low—A stronger trade balance could stabilize the U.S. dollar, reducing inflationary pressure.

• Challenges: Requires long-term restructuring of U.S. trade policies and industries.

(B) Resource-Based Fund (High Success, Low Inflation)

• Mechanism: Uses revenue from oil, gas, and mineral extraction, akin to Norway’s oil fund.

• Feasibility: The U.S. is a major energy producer, making this viable.

• Inflation Risk: Low—Stable and predictable income from resource royalties does not directly increase inflation.

• Challenges: Would require higher taxation or partial nationalization of energy resources, which faces political opposition.

(C) Tax Revenue-Based Fund (Moderate Success, Moderate Inflation)

• Mechanism: Redirects a portion of corporate or capital gains tax into an SWF.

• Feasibility: Politically controversial, as it diverts funds from government spending.

• Inflation Risk: Moderate—Could reduce consumer and business spending, but investing in productivity-enhancing areas would mitigate this.

• Challenges: Congress may resist reallocating tax revenue from existing programs.

(D) Infrastructure & Innovation Investment Fund (Moderate Success, Initially High Inflation, Long-Term Deflationary)

• Mechanism: SWF funds domestic projects like AI, automation, and green energy to boost economic productivity.

• Feasibility: Strong potential for long-term national competitiveness.

• Inflation Risk: Initially High, Then Deflationary—Construction and technology investments may increase costs short-term, but productivity gains will lower inflation in the long run.

• Challenges: Requires sustained investment and government oversight to prevent inefficiencies.

(E) Tariff-Based Fund (Moderate Success, High Inflation)

• Mechanism: Uses revenue from import tariffs to fund the SWF.

• Feasibility: Tariffs already generate revenue, making this viable in the short term.

• Inflation Risk: High—Tariffs raise the cost of imported goods, which increases inflation.

• Challenges: Could lead to retaliatory tariffs from other countries, hurting U.S. exports.

(F) Borrowing-Based Fund (Low Success, Very High Inflation)

• Mechanism: U.S. issues low-interest debt to fund an SWF, investing in global assets.

• Feasibility: The U.S. can borrow cheaply, but it would add to national debt.

• Inflation Risk: Very High—Increases money supply and could reduce investor confidence in U.S. Treasuries.

• Challenges: Politically untenable given the already high debt burden.

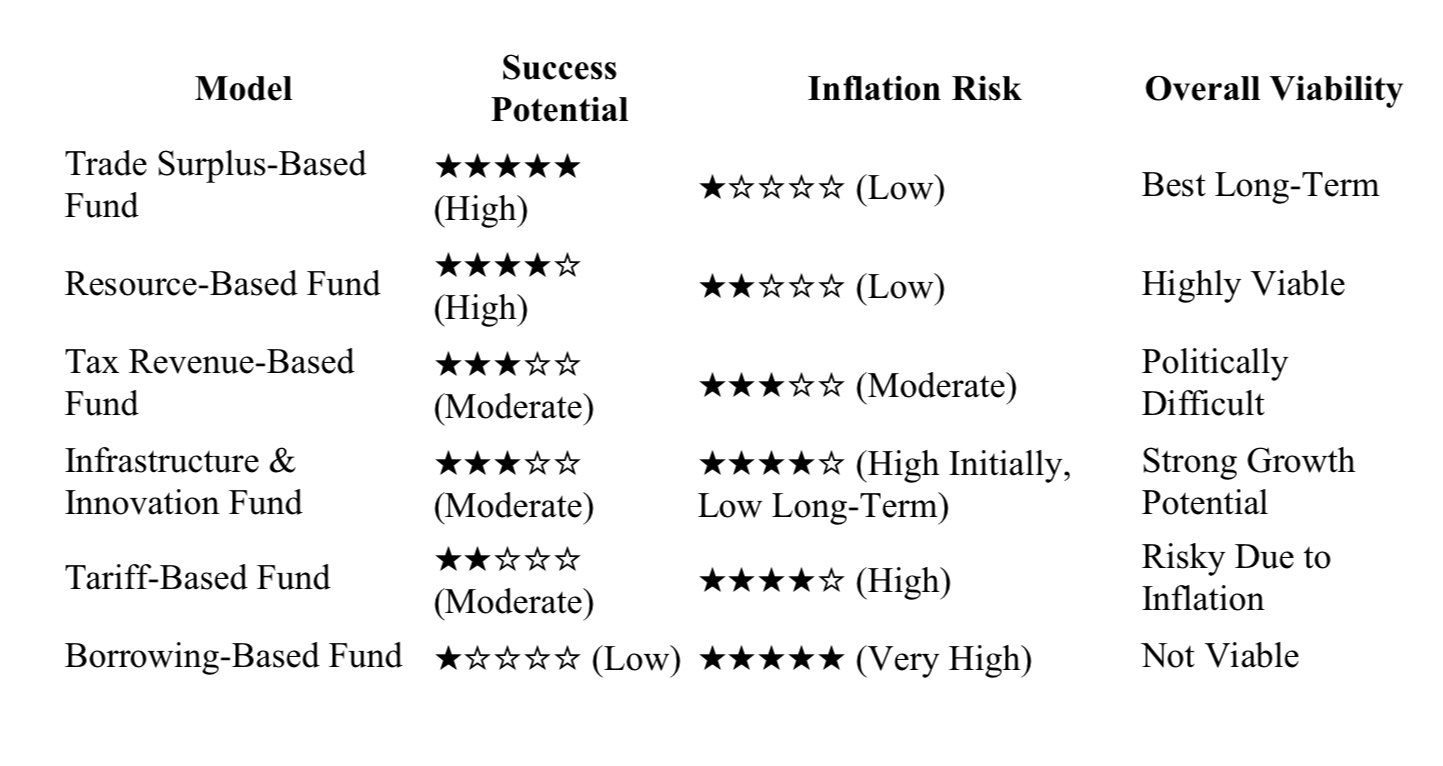

2. Ranking the Models by Success Potential and Inflation Risk

3. Conclusion: The Best Path for a U.S. Sovereign Wealth Fund

The most effective and sustainable approach for a U.S. SWF would be a combination of the trade surplus model, resource-based model, and selective tax allocation.

• The trade surplus approach is the best long-term strategy, but it requires structural changes in U.S. trade policies.

• A resource-based SWF is viable immediately, using energy and mineral royalties without causing inflation.

• If combined with technology investments, the SWF could fund projects that increase national productivity, offsetting inflation risks over time.

Final Recommendation:

1. Start with a Resource-Based Fund (leveraging energy revenues).

2. Gradually transition to a Trade Surplus-Funded Model through export growth.

3. Allocate a portion of corporate or capital gains tax to the SWF once it’s established.

4. Invest in productivity-enhancing projects (AI, green energy, automation) to reduce inflation in the long run.

This hybrid approach balances economic growth, inflation control, and political feasibility, making it the most realistic path for the U.S. to build a sovereign wealth fund.