Global Economic Update

The week of April 8-12, 2024, presented a multifaceted view of global economic dynamics, highlighted by robust job growth in the United States and persistent inflation pressures that are reshaping expectations for monetary policy across major economies. In the U.S., a strong Non-Farm Payroll report and rising inflation have tempered expectations for Federal Reserve rate cuts, suggesting a prolonged period of high interest rates that could influence global investment flows and currency stability. The European Central Bank and the Bank of England are navigating similar challenges, with potential rate cuts on the horizon as inflation shows signs of easing. Meanwhile, advancements in AI continue to promise significant shifts in the technological landscape, potentially redefining industry standards and economic interactions worldwide. These developments collectively underscore the intricate interconnections between labor markets, monetary policies, and technological advancements, shaping a complex but cautiously optimistic global economic outlook.

United States

Labor Market and Economic Growth: The U.S. labor market showed robust health with the addition of 303,000 jobs in March, surpassing expectations and nudging the unemployment rate down to 3.8%. This strength in job creation bolsters President Biden’s re-election bid and reflects a buoyant economy.

Inflation and Interest Rate Projections: Despite strong job growth, inflation rose to 3.5% in March, signaling ongoing price pressures. This has led to a recalibration of expectations for Federal Reserve interest rate cuts, with markets now less optimistic about reductions in 2024. The Fed’s cautious stance, emphasized by Fed Chair Powell’s remarks on needing “greater confidence” that inflation is easing, suggests that high rates may persist, impacting global investment flows and currency valuations.

United Kingdom

Interest Rates and Housing Market: Traders anticipate two 25bps rate cuts by the Bank of England later in the year, reflecting a potential easing in monetary policy as inflationary pressures recede. This outlook is boosting housing market optimism, with increased mortgage approvals and rising inquiries in the real estate sector.

Eurozone

Economic Stabilization: The ECB maintained its benchmark deposit rate at 4%, though some policymakers pushed for an immediate cut. This cautious approach aims to ensure stability before any rate reductions, with signs pointing to potential cuts by June if inflation continues to moderate.

Japan

Wage Dynamics and Monetary Policy: Real wages in Japan fell by 1.3% year-over-year in February, a reflection of rising inflation outpacing income growth. This has implications for consumer spending and broader economic activity. The Bank of Japan is navigating the end of its massive stimulus program, with speculation about further interest rate hikes by autumn.

China

Manufacturing and Economic Recovery: China’s Manufacturing PMI rose to 50.8 in March, indicating expansion and a positive trajectory for the economy amidst challenges like the property market slowdown.

Artificial Intelligence (AI)

Innovation and Competition: AI developments are significant, with OpenAI and Meta nearing the release of models capable of advanced reasoning. This technological leap is poised to transform industries and economies, highlighting the critical role of AI in future economic paradigms.

Environmental, Social, and Governance (ESG)

Energy and Infrastructure: Discussions around ESG are intensifying, with the European Round Table for Industry highlighting the need for substantial investments to meet climate goals. The global coal fleet’s growth, driven by China and a slowdown in closures in the EU and the US, underscores the ongoing reliance on fossil fuels.

Analysing Fixed Income Strategies: Credit Funds and Long-Term U.S. Treasuries in a Fluctuating Market

In an era where Federal Reserve rates make headlines and market volatility often feels like the norm, securing a steady 5% yield over the next 10 to 15 years stands as a key challenge for many investors.

Navigating this landscape requires a strategy that not only weathers the ups and downs of the market but also aligns with your long-term financial goals.

How can one achieve this balance and maintain peace of mind amid fluctuating interest rates and economic uncertainties? This exploration of fixed-income strategies offers insights into two contrasting paths: dynamic credit funds and the more predictable terrain of long-term U.S. Treasuries.

In the realm of fixed-income investment, choices often boil down to dynamic credit funds or the stability of long-term U.S. Treasuries. Each path offers distinct risk and reward profiles, especially against the backdrop of changing interest rates.

Credit Funds: High Yield, High Management

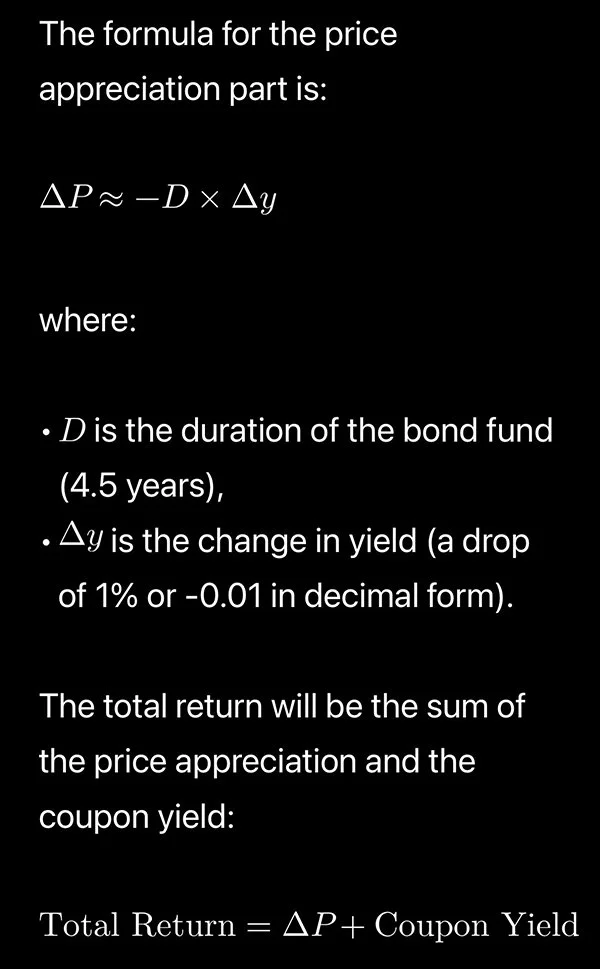

Credit funds, investing in a blend of corporate and government bonds, chase higher yields by balancing high-quality and high-yield bonds. However, their performance is highly susceptible to interest rate movements. For example, in a fund with an average yield of 5% and a 5-year duration, a 1% decrease in interest rates could result in a bond price appreciation of approximately 5%. Combined with the yield, this leads to a total return of around 8%.

This manoeuvring for higher yields, however, comes with a balancing act between risk and return, especially in rising interest rate scenarios.

Long-Term U.S. Treasuries: A Pillar of Stability

In contrast, long-term U.S. Treasuries, with maturities of 10 or 15 years, offer a more predictable investment route. Assuming a 4.5% to 5% yield, the impact of interest rate changes is more pronounced due to their longer durations. For instance, a 10-year Treasury bond with a 4.5% yield and a 7-year duration could see an approximate total return of 11.5% with a 1% rate decrease, considering both the yield and price appreciation. A 15-year Treasury bond with a 5% yield and a 12-year duration could potentially yield a total return of about 17% under similar conditions. This route is often favored for its stability, predictable returns, and lower default risk.

The Risk-Reward Balance

These scenarios underline the fundamental trade-off between these investment approaches. Credit funds offer the potential for higher income but also bring increased market risk and management complexity. In contrast, long-term U.S. Treasuries provide lower yields but greater price appreciation potential in falling interest rate environments, along with higher security.

Conclusion

Navigating between credit funds and long-term U.S. Treasuries requires balancing one’s risk tolerance, investment horizon, and economic outlook. While credit funds might be suitable for those seeking higher yields and who are comfortable with active management, long-term U.S. Treasuries appeal to those prioritizing stability and safety. Understanding these dynamics, aided by numerical examples, can provide investors with a more transparent framework to make informed decisions tailored to their financial goals.

Please note: The simple calculations of bond price appreciation presented in this essay are rough estimations for illustrative purposes only. They are not precise predictions or financial advice.