Global Currency Assessment: Navigating Yield Curves and Deposit Rates for Savvy Investors

In the intricate dance of global finance, deposit rates and yield curves are key performers, each move telegraphing signals about economic expectations and fiscal health. Investors seeking to optimise returns on cash holdings must pay close attention to these indicators.

This report delves into the nuanced realm of deposit rates in conjunction with yield curve analysis, offering insights into the top five currencies currently presenting attractive opportunities for savers and investors alike.

In the realm of international finance, the yield curves and deposit rates of a nation serve as a barometer for its economic climate. As such, discerning investors would do well to consider these indicators in their decision-making process.

The top 5 currencies we are looking at:-

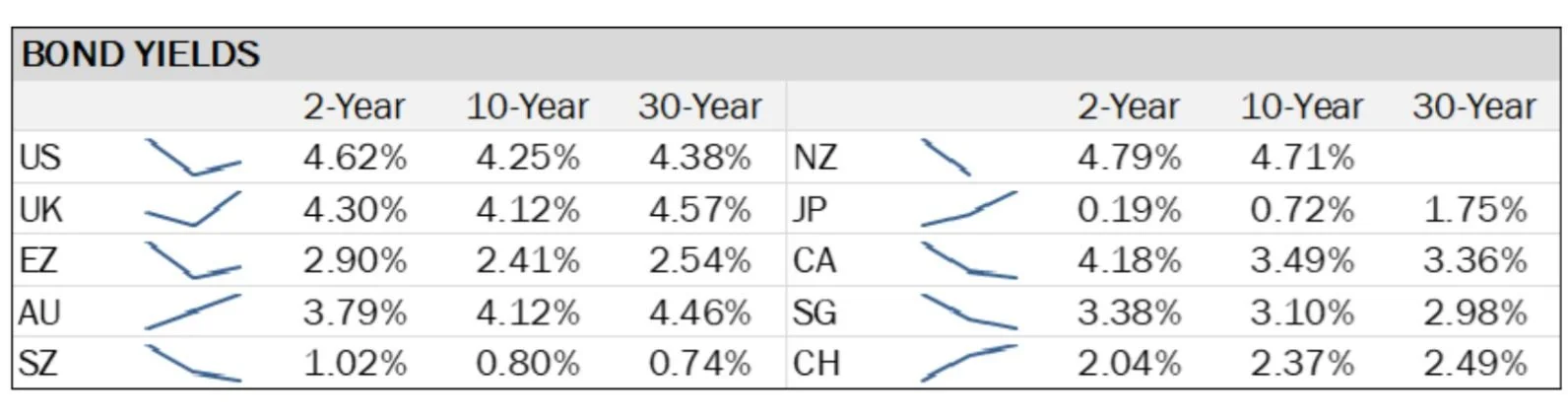

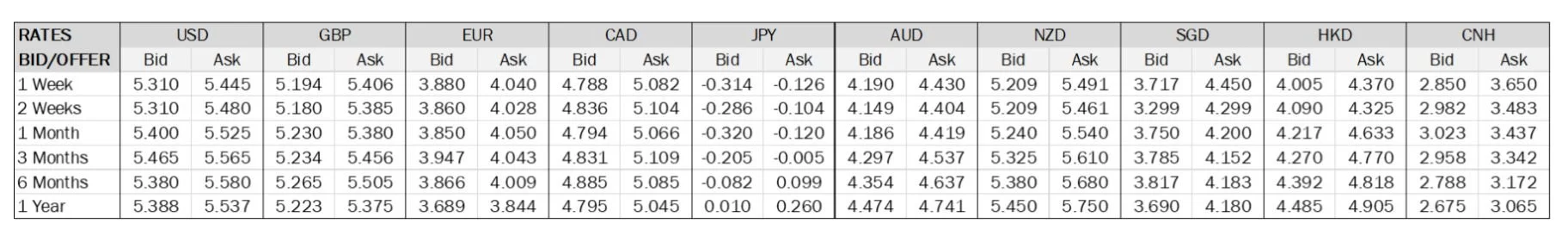

(1) U.S. Dollar (USD): The U.S. exhibits high deposit rates, reflecting the Federal Reserve's aggressive stance against inflation. Despite an inverted yield curve signalling potential economic headwinds, the USD's global reserve currency status often classifies it as a 'safe-haven', making it an attractive option for risk-averse investors.

(2) Australian Dollar (AUD): Australia's deposit rates are compelling, and its upward-sloping yield curve indicates an optimistic economic outlook. The country's robust commodity sector and stable political landscape further bolster the AUD's position as a favourable currency for deposits.

(3) Singapore Dollar (SGD): The SGD’s competitive deposit rates, juxtaposed with an inverted yield curve, present a complex economic signal. While the solid deposit rates may appeal to savers seeking returns, the inverted yield curve typically suggests market anticipation of lower interest rates in the future, often associated with a cautious outlook on economic growth. Despite this, Singapore’s strong reputation for regulatory oversight and financial stability continues to make its currency a potentially attractive option for preserving capital.

(4) New Zealand Dollar (NZD): With higher deposit rates and a positive yield curve, the NZD could be an appealing choice. However, the minor, open nature of New Zealand's economy, which often fluctuates with global trends, adds a layer of complexity to potential investments.

(5) Canadian Dollar (CAD): The CAD's moderate deposit rates and upward-sloping yield curve indicate healthy economic growth expectations. Canada's significant natural resources and symbiotic financial relationship with the U.S. contribute to the CAD's position as a viable option for investors.

While the deposit rates and yield curve provide a snapshot of potential investment returns, they come with the usual caveat: the possibility of inflation eroding actual returns and currency risk affecting the value of investments. Therefore, it is prudent for investors to not only chase higher yields but also to consider the overall economic stability and monetary policy outlook of the currency's home country.

In conclusion, synthesising deposit rates with yield curve insights offers a strategic vantage point for evaluating currencies. The currencies highlighted herein stand out in the current financial landscape, each with merits and risks.