Deciphering the U.S. Economic Momentum: A Juggernaut in Disguise?

U.S. Job Openings and Labour Turnover Survey (JOLTS) 2019-2024

Introduction:

At first glance, the recent downtrend in the U.S. Job Openings and Labor Turnover Survey (JOLTS) might paint a picture of an economy losing steam. Yet, an intricate look at a constellation of economic indicators paints a far more dynamic picture. This narrative, replete with insights from the Federal Funds Rate, Consumer Price Index (CPI), private fixed investment, personal consumption expenditures, GDP growth, and unemployment rates, reveals an underlying economic robustness. This essay aims to dissect these layers, centring on the JOLTS data, to unveil a U.S. economy that appears not as a behemoth in retreat but as a juggernaut, tactfully navigating its economic path.

The JOLTS Narrative:

JOLTS data has shown a tempering of job openings, hinting at a potential plateau in labour market activity. This moderation, rather than a sign of decline, might suggest a labour market balancing itself post a period of intense expansion, now nearing full employment—a mature sign of economic health.

Federal Funds Rate as a Counterbalance:

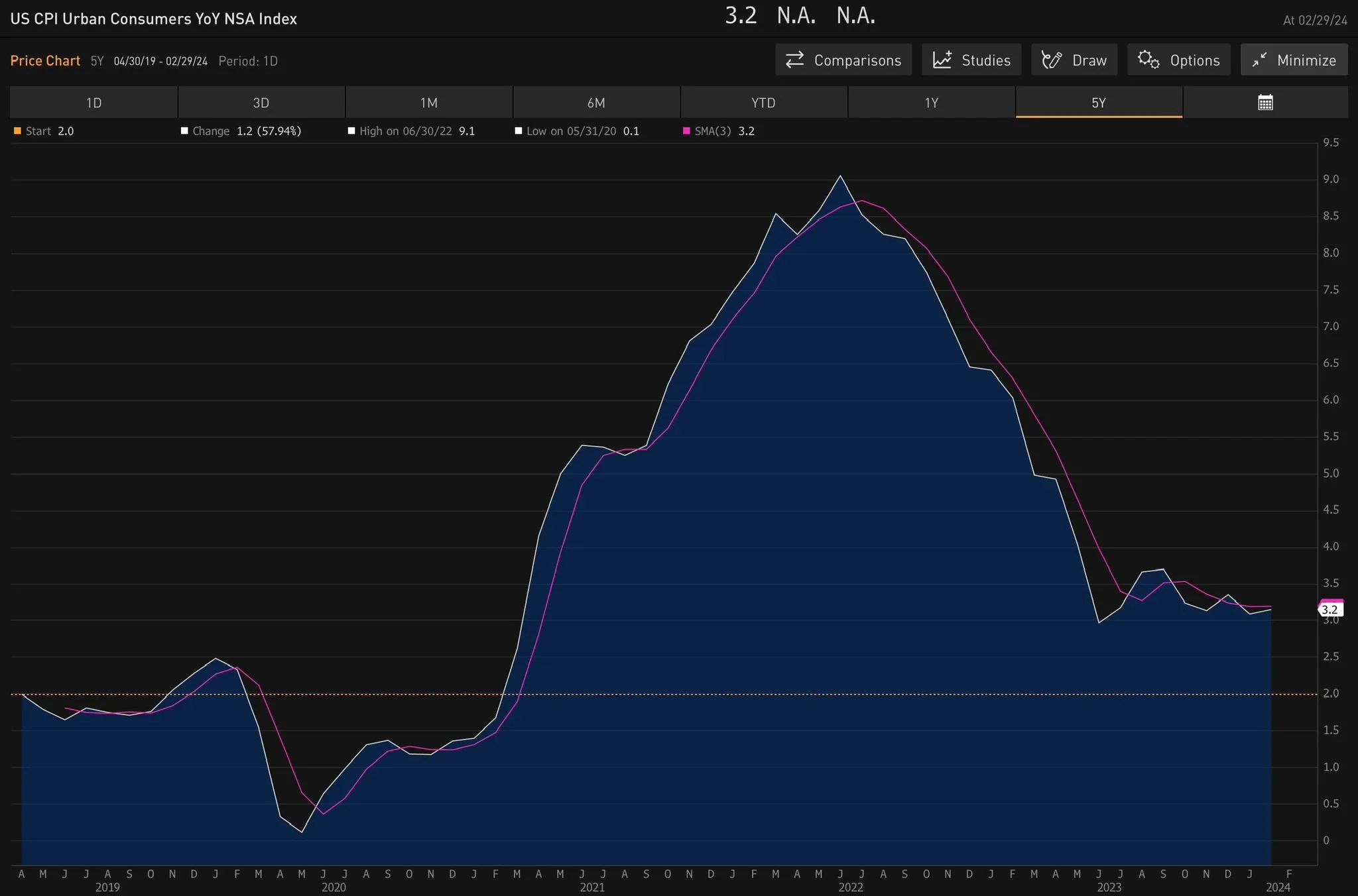

The Federal Funds Rate’s rise indicates deliberate economic tightening by the Federal Reserve in response to inflation concerns—a move to preemptively cool an economy possibly running too hot. This has been paralleled by the CPI’s YoY data, which, after a pronounced spike, demonstrates a recent downtrend, hinting at a softening of inflationary pressures and the potential effectiveness of monetary policies.

Synergy with Other Indicators:

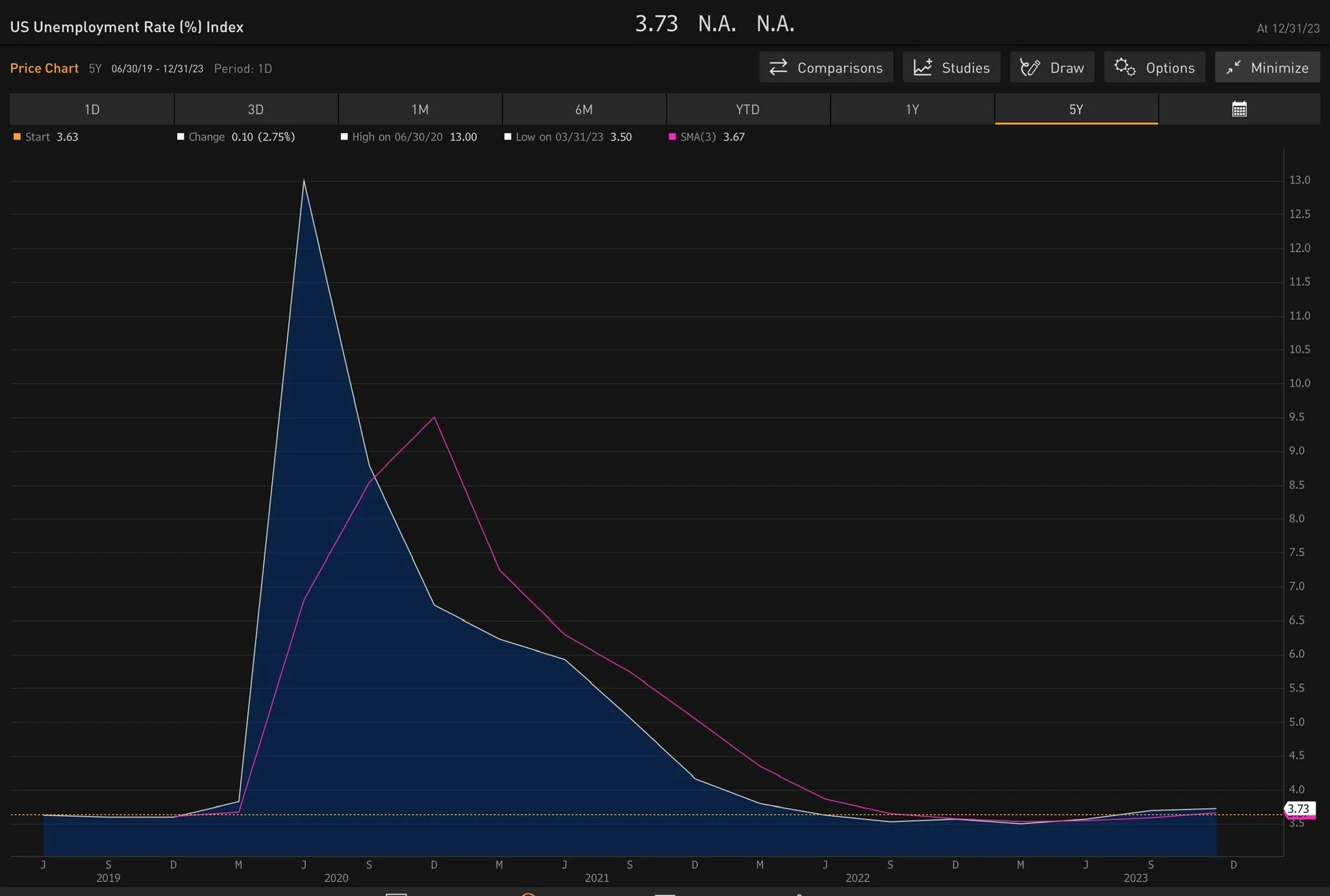

Against the backdrop, other indicators have continued to show vigour. BEA’s Private Fixed Investment Index has depicted solid business investment as a precursor to future productivity. The Personal Consumption Expenditures (PCE) Index suggests resilient consumer spending, and GDP growth rates have been largely positive despite their natural undulations. After the pandemic’s peak, the unemployment rate has reverted to historic lows, underscoring a strong labour market.

Integrating Bloomberg’s Visual Insights:

The graphical representations provided by Bloomberg amplify these narratives. The visible ascent in private investment highlights businesses’ confidence. A stable PCE underscores the U.S. consumer’s ongoing contribution to economic activity, while the GDP’s YoY SA Index reveals an economy that has absorbed shocks and sustained growth. The low unemployment rate is a testament to the economy’s capacity to generate jobs consistently.

Conclusion and Investor Perspective:

When these indicators are viewed collectively, they suggest that far from losing its stride, the U.S. economy is calibrating with precision. The JOLTS data’s tempering is a single facet of a multifaceted economic engine that continues to churn powerfully. The Federal Reserve’s anticipated rate cuts may be the strategic lubrication needed to maintain this engine’s momentum without overheating. For investors, the message is clear: the U.S. economy remains a juggernaut, subtly steering through global uncertainties and domestic recalibrations. Agility and a comprehensive view of economic indicators will be critical in identifying and seizing growth opportunities in this environment.

Acknowledgements:

The charts used herein, sourced from Bloomberg, are included under appropriate licensing and are intended for illustrative purposes, providing visual content to complement the analysis of the U.S. economy’s performance.

US Unemployment Rate

US GDP Year on Year

US BEA Private Fixed Investment Index

US Fed Funds Effective Rate

US CPI Year on Year